Considering Donating an Item To a Museum?

I had a long conversation with my CPA recently, in which we discussed exactly what the Internal Revenue Service requires if you want to take a tax deduction for an item you plan to donate to a museum. Before going any further, however, let me declare that I am not a tax expert and my explanation below is in layman’s terms, so you should consult with your tax preparer before proceeding.

First, the museum, library, or non-profit organization must be legitimate and must be deemed an appropriate depository for the item you are donating.

Second, the amount of documentation required is in direct relationship to the “fair market value” of the item.

Regardless of its value, for each item the IRS requires a Donation Receipt which you would create that would include your contact information, a complete and detailed description of the item, the name of the museum, a signature of the person accepting it, the date, the fair market value, your cost of the item, and your “method of valuing the property.”

Additional documentation is required for the following ranges of your item’s fair market value:

Less than $250 – Nothing more is required than the Donation Receipt, signed by the appropriate person at the museum to whom you are making the donation.

$250 – $500 – In addition to the signed Donation Receipt, you must arrange for the museum to provide you with a Letter of Acknowledgment written on their official letterhead and signed by the appropriate representative.

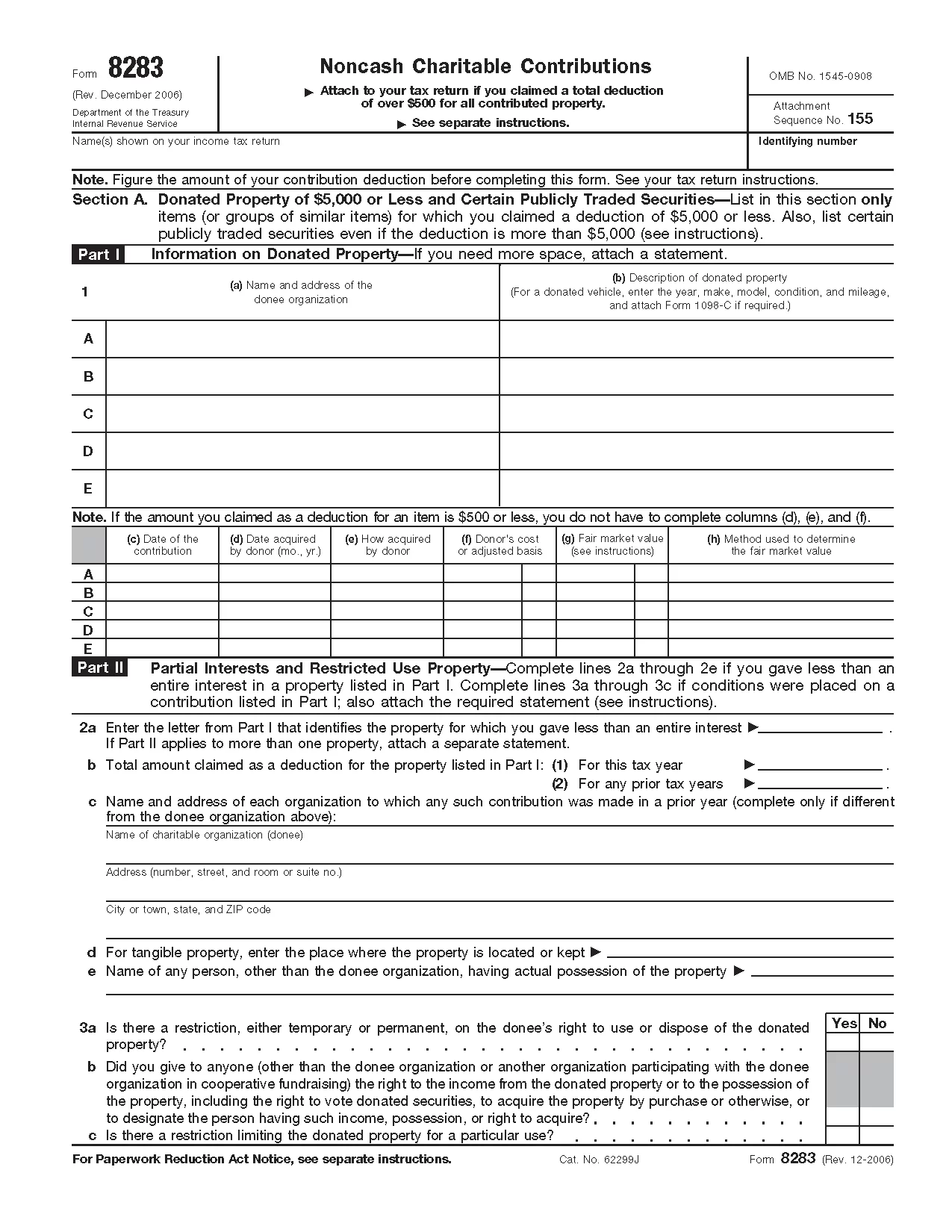

$501 – $5000 – In addition to the signed Donation Receipt and the Letter of Acknowledgment, you must complete the appropriate sections of IRS tax form #8283: “Non-Cash Charitable Contributions.” This asks for much of the same information contained on your Donation Receipt, but does not require an independent third-party appraisal.

Over $5000 – In addition to all of the above, this donation requires that an additional section of form #8283 be completed, which includes the signature of a qualified appraiser, as well as the signature of the person at the museum who accepted the donation.

As a final preliminary note, my CPA informed me that the IRS can reject or modify the “fair market value” which you and/or your appraiser have assigned to any item if they feel it has been inflated. To avoid that situation, he advised including on your Donation Receipt the detailed means by which you ascertained the value of your item, such as the amount you paid for it, what comparable items have sold for at auction, the titles of any price guides you used as reference, etc.

My own suggestion: in addition to consulting in advance with your tax preparer, print out a copy of IRS form #8283 and include each category listed on it in your Donation Receipt, for when it comes to the IRS, you can never have too much information or documentation.

by Bruce Johnson